Investing in diamonds to secure your savings

More than ever, in the light of these new 2016 reforms (BRRD…), investment diamonds are a real alternative to secure your savings.

Outlined below are several reasons toinvest in diamonds :

- A sound investment

Investing in diamonds is still a sound investment: every stone will continue to be valuable due to its own technical characteristics that cannot be depreciated. Moreover, their price is totally unrelated to nation states or the performance of other assets (such as shares).

- A scarce resource

Diamonds are increasingly scarce due to the depletion of existing mines and the fact that no new diamond mines have been discovered.

- Increased demand

Demand is ever-rising. Diamond prices are set to increase over the coming years. After the fall of prices in 2014 and 2015, diamond prices rose at the beginning of 2016. While the United States have reduced their purchases since the 2008 crisis, China and India are investing more and more in the diamond industry. Furthermore, the world population is set to be 9 billion by the year 2050, and the number of diamond buyers will increase proportionally.

- Tax benefits

Loose diamonds belong to the private property category and are taxed on capital gains when sold. For all transactions below 5,000 Euro, they are exempt from taxes and above this sum; the rate of tax in France is 6.5%.

- An international exchange currency

Diamonds are an international exchange currency, as they will always be traded for money. Diamond prices are set by the Rapaport Index that establishes an average of prices listed in the Diamond Bourse and determines the price of diamonds in dollars before taxes.

- Incomparable density value

Diamonds are easy to store. They take up less space than gold and are undetectable. Nothing else on the market compares to diamonds in terms of value density compared to their volume.

Investment diamonds are a real alternative for investors. Indeed, if diamonds are currently a little-known savings product they are nonetheless a good means of diversifying investment products and ensuring security.

Our advice for investing in diamonds :

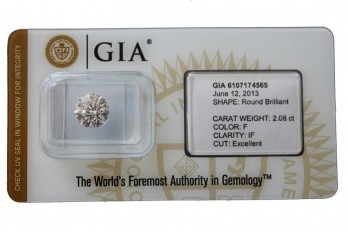

If you are considering investing in diamonds, we recommend you invest in only round diamonds that have a D or E colour, IF, VVS1 or VVS2 clarity, excellent cutting quality at all levels (proportion, polishing and symmetry) with little or no fluorescence (“slight” or “faint” maximum).

We also advise you to have your stones certified by one of the three internationally recognised laboratories : GIA, HRD or IGI.

In addition, it is better to have the stone laser-engraved and sealed by the laboratory in order to recognise the diamond and identify it in the event of theft.

Be aware that there are rare weights in our profession. Below are the rankings of interest :

- 0.60 – 0.69 ct

- 0.80 – 0.89 ct

- 0.95 – 0.99 ct

- 1.20 – 1.49 ct

- 1.70 – 1.99 ct

- 2.50 – 2.99 ct

- 3.50 – 3.99 ct

- …

Diamonds with a weight included in these ranges are worth slightly more and will have greater capital gains over time, as they are particularly scarce on the diamond market. Indeed, when diamond cutters cut a rough diamond, they are often confronted with the choice between cutting a 1.50 ct diamond with poor cutting proportions and creating a 1.25 ct stone that will get three “excellent” scores in cutting. It is worth knowing that the pricing scheme for diamonds between 1.50 ct and 1.99 ct is vastly superior to those that weigh between 1 ct and 1.49 ct. Yet on the current market, it is very difficult to sell diamonds with a cutting quality below three “very good” scores.

The market is slowly leaning towards a standard of three “excellent” scores.

Finally, note that to obtain three “excellent” scores, approximately 80% of the raw material is lost when a diamond is cut !

The three “excellent” scores guarantee maximum optimisation of the diamond’s brilliance.

Cutters have become engineers. They work with high-performance computer-assisted tools.

By combining excellent colour, clarity, cutting quality (proportion, polishing and symmetry), little or no fluorescence and a rare weight – all criteria are met for your investment diamond to gain maximum value.

Thus, the only condition for having a good investment product is to buy a diamond of very good quality. This explains why, it is important to be in contact with recognized experts. Diamant-Gems is an essential partner in this field and will be able to advice you.

We would be pleased to welcome you in our Paris, Antwerp or Geneva offices in order to discuss your investment plans or to present our stones. Contact us !

Online sales of investment diamonds, be careful of lying advertisements !

Whether you are in difficult financial times, interested in making money quickly and easily, or want to find an attractive way to invest your money in a real (physical) asset, this article has been written for you!

Increasingly on internet or on TV, we see blooming ads inciting people to invest their money in investment diamond. At stake, these companies promise you “exceptional returns, even unrealistic”, which prove to be risky. Diamond remains a safe and sustainable investment product. The price of diamonds has increased steadily over the years. However, as with all financial investments, there are better years than others.

At the beginning of January 2017, the Autorité des marchés financiers (AMF) called on individuals to be vigilant about these companies, which promised sales without… Diamonds are very often stored in border countries as in The Swiss Ports-Francs. However, you should know that if you want to recover your diamond, past the border, you will have to pay the VAT fee. In addition, if you wish to resell it without having previously regularized your diamond with the tax authorities of the country in which you are domiciled, you will be unable to put your diamond back on the market.

So, if the promotional message intrigues you or seduces you, you must be twice as careful and gather as much information as possible about these companies to protect you! Indeed, many people are victims and fail to recover their initial investment. Epargne Info Service (EIS) reported “a resurgence of diamond investor appeals since last summer”. “Some forty platforms sell diamonds” and approach the general public. To avoid any problems, we invite you to contact the EIS to answer your questions about savings products. They will warn you about doubtful companies in which it is not advisable to invest their money.

Moreover, “AMF advices investors to not responding to solicitations, sometimes aggressive, from these entities and not relaying them to third parties”. Also, it is better to point them out. “AMF also notes that the prestigious addresses of these companies are often fictitious” and call for great vigilance.

Diamant-Gems remains at your disposal to advise and guide you in your diamond investment project.

Epargne Info Service : 01 53 45 62 00

Sources :

« L’Autorité des marchés financiers déconseille d’acheter des diamants sur Internet » (The Autorité des marchés financiers advises against buying diamonds on Internet) written by Jérôme Porier and published on 9th January 2017, in the magazine Le Monde.

« Le faux éclat du diamant » (The fake brightness of diamond) written by Carole Papazian and published on 13th January 2017, in the magazine Figaro.

2017 : A worrying economic context

You will find below the new legislation in progress :

A new directive for 2016 : the BRRD (02/2016)

On 1st January 2016, a new international directive came into force and is applied to the different member states of the European Union. It is the « Bank Recovery and Resolution Directive ». It consists in mobilising large deposits to save banks in the case of bankruptcy.

What is the BRRD ?

The new directive functions as a rule to save banks. In the case of bankruptcy, banks will mobilise “large deposits” to meet their needs. Contrary to what occurred previously when banks received external bailouts from the states and taxpayers, Banks now have the right to help themselves to their own customers’ savings. This is known as bail-in.

In the event of default, the banks will first mobilise shareholders, then their bondholders (who alongside the shareholders will bear the equivalent of up to 8% of the total balance) and finally, their clients (companies and individuals).

Many people are concerned as the new system targets popular saving schemes !

Indeed, if your bank goes bankrupt, all of your accounts in this bank are theoretically guaranteed up to 100,000 euros per person. This means that someone who has 150,000 Euro on his accounts could lose up to 50,000 Euro if their bank goes bankrupt.

The new directive is real and has already been applied in many European countries such as France, Belgium, Italy and Portugal…

The new directive is real and has already been applied in many European countries such as France, Belgium, Italy and Portugal…

The directive did not appear as if by magic and was used three years ago, in Cyprus, during the outbreak of the Greek crisis in 2013.

Source : « Le jour où on mettra la main sur vos économies » (The day we get hold of your savings) written by Sébastien Buron and published on 4th February 2016, in the magazine Trends.

Government bonds, the explosion of negative interest rates (03/2016)

Unthinkable for a long time, negative interest rates have become commonplace. Investors are now willing to pay to be able to lend money to a third party. Why? Because encouraging banks to stop stocking money in the central bank so as to lend it to companies or households, consequently creates growth and inflation. The European Central Bank and its president, Mario Draghi, have adopted this method to reduce the risk of deflation.

Several questions arise :

- What to invest in if nothing has a return ?

- Is it better to keep your money in cash at home ?

More than ever, investment diamonds are a real solution for an investment that pays.

Source : “Emprunts d’Etat : l’explosion des taux d’intérêt négatifs” (Government Bonds: The Explosion of Negative Interest Rates), by Clément Lacombe (11/03/2016) in the magazine Le Point.

New law on life insurance in France, the contagion is likely to all Europe !

Life insurance : a hidden time bomb in the Sapin Law II (11/2016)

« In the last few days, a number of players are concerned about a measure included in the Sapin Law II, which aims to give to the authorities the power to put pressure on the returns of funds in euros, or even to freeze payments and redemptions life insurance in the event of crisis ».

Indeed, Michel Sapin, Minister of the Economy and Finance would like to reduce the interest rates of life insurance to make them less attractive and thus dissuade savers from immobilizing too much money on this type of product. In addition, he wants to be able to temporarily block the sums invested on life insurance in case of severe crisis to avoid a financial disaster!

From 8 November 2016, public authorities may arbitrarily fix the yields of life insurance. They can also set negative rates, that is, take a portion of your savings. The Sapin Law II will enable the State to use your life insurance legally. Similarly, this law will allow to suspend, delay or limit your withdrawals on your life insurance.

Therefore, as a result of this new law, it is important to diversify its investment products.

Sources :

« Assurance vie : pourquoi les autorités veulent pouvoir limiter les rendements et geler les retraits » (Life insurance: why authorities want to limit yields and freeze pensions) written by Thomas Le Bars and published on 28th September 2016, in the magazine Capital.

« Assurance-vie : les épargnants inquiets » (Life insurance: worried savers) published on 1st October 2016, in the magazine Le Monde.

« Assurances-vie : une bombe à retardement cachée dans la loi Sapin risque de faire exploser le système » (Life insurance: a time bomb concealed in the Sapin law could explode the system) published on 28th September 2016, in the magazine Atlantico Business.

« Assurance-vie: épargnants, aux abris! » (Life insurance: savers, shelters!) written by Delphine Granier and published on 4th October 2016, in the magazine Challenges.

Perrin Olivier, le vaillant petit économiste

Investigation : Investment diamond, new diversification asset ?

Chloé Consigny, Gestion de Fortune (January 2014)

At a time where savers are desperately looking for returns, alternative investment offerings abound. Since two years, a new product comes back to the point: the investment diamond. […]

Consult the survey. (in french)